Let’s go back to the savings account example above and use the daily compound interest calculator to see the impact of regular contributions. See how your savings and investment account balances can grow with the magic of compound interest. Compound interest causes investments to grow faster, but also causes debt to grow faster. It’s important to understand what type of interest that you are earning on investments or accruing on debt so that you can properly plan for future earnings and payments. The majority of credit cards compound daily, so it’s important to understand the principal and interest payment each month and have a plan to pay it off. We can also select an annual interest rate in the daily compound interest calculator.

Compound Daily Interest is a powerful force in the world of finance. It calculates interest on your principal amount, including previously earned interest, on a daily basis. This means your investment grows faster compared to simple interest, where interest is calculated only on the principal amount. Understanding this concept is crucial for anyone looking to maximize their financial growth.

Terms & Info

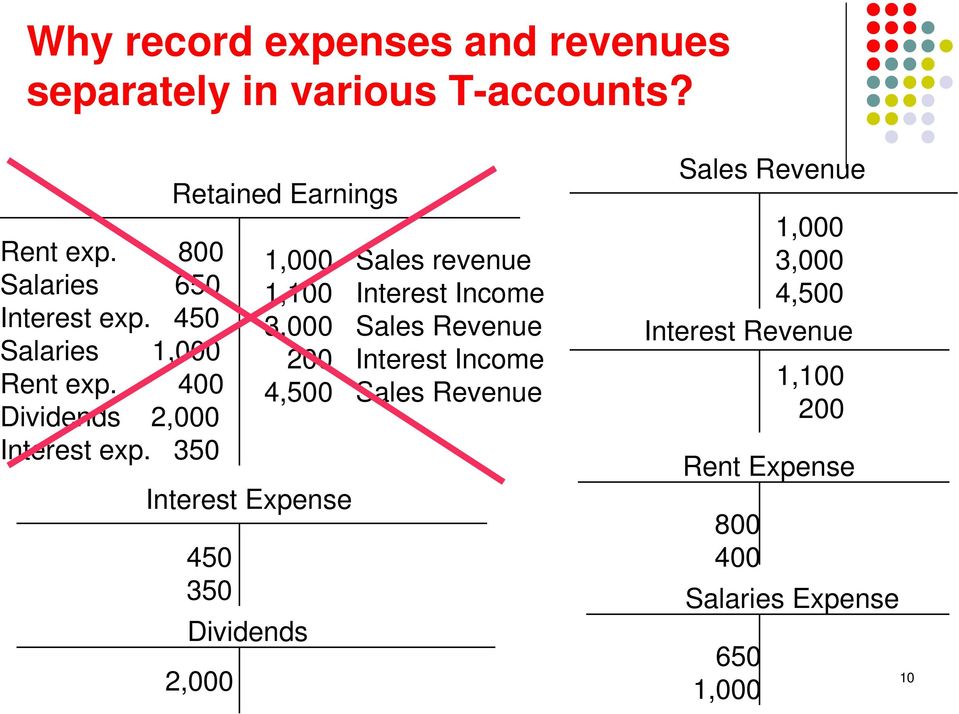

Compounding is the process in which an asset’s earnings are reinvested to generate additional earnings over time. Compound calculators do not take into consideration fees, taxes, dividend reinvestments, or other economic or market factors that may impact performance. Actual investment results may be materially different than portrayed. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principle. References to past performance do not guarantee future results.

Then you would owe a percentage of both the original loan balance plus any of the previously accumulated interest. Simple interest is a little different from compound interest. You’ll typically see simple interest rates charged annually on mortgages, car loans, or personal loans. Don’t let this napkin math guide your investment strategy, but as a launching pad, asset turnover ratio formula real-word examples and interpretation the Rule of 72 can be helpful.

Compounding investment returns

- The benefits of compounding for investors come primarily through regular and systematic growth in the principal balance.

- Actual investment results may be materially different than portrayed.

- For example, let’s say you wanted to calculate monthly compound interest.

- If you'd prefer not to do the math manually, you can use the compound interest calculator at the top of our page.

- As you can see, by the sixth month, the account that compounded monthly already lagged behind the account that had the 1% better interest rate.

- The compounding of interest grows your investment without any further deposits, although you may certainly choose to make more deposits over time – increasing efficacy of compound interest.

Welcome to the world of financial growth, where understanding compound daily interest can unlock your investment potential. Our online calculator simplifies this concept, turning complex calculations into easy-to-understand results. Whether you’re a seasoned investor or just starting, this tool is designed to enhance your financial planning. Experience the 15 very important tips for aspiring entrepreneurs to success ease of obtaining precise calculations and the convenience of downloading results in PDF or XLS formats.

Sign up today and set a recurring investment

This generates additionalinterest in the periods that follow, which accelerates your investment growth. Daily compound interest is calculated using a version of the compound interest formula.To begin your calculation, take your daily interest rate and add 1 to it. Then, raise that figure to the power of the number of days you want to compound for. Subtract the starting balance from your total if you want just the interest figure.

Because stocks and other equities tend to have a higher rate of growth than bonds or cash, the effect on a portfolio is similar to that of compound interest. In both cases, you allow the time value of money to work for you. But history shows that the U.S. stock market has always grown over time, so this annual return represents how you expect your investments to grow on average and over the long term, not every single year. A 7% return is an estimate based on the growth of the general market over the last hundred years, but more conservative investors may consider reducing this. The TWR figure represents the cumulative growth rate of your investment. The effective annual rate (also known as the annual percentage yield) is the rate of interest that you actually receive on your savings or investment aftercompounding has been factored in.

A dollar that you invest today will be worth significantly more down the road than a dollar invested a month or a year from now. When you are the investor (or the person to whom the interest is owed), more frequent compounding is a benefit. One can you borrow against your escrow of the key benefits of compound interest is that it can allow your investments to outpace the effect of factors that can erode wealth, such as inflation. If you’re interested in other calculators like this, check out the MarketBeat retirement calculator, the MarketBeat stock average calculator and for options traders, the MarketBeat options profit calculator. This is the interest rate for the bond or interest-bearing account.